Claims that a Satoshi-era Bitcoin whale suddenly returned to the market with a multi-billion-dollar purchase have injected tension into an already fragile Bitcoin price action. The claims gained traction after social media posts on X revealed that an address dormant since 2011 had accumulated roughly 26,900 BTC, a move framed by some as a powerful bullish signal.

However, a few others saw something very different. One warning revealed that the timing and context of the transfer pointed toward a setup that could lead to a large-scale distribution.

Why Some Traders See A Major Red Flag

Claims that a Satoshi-Era Bitcoin address might be actually buying billions of dollars’ worth of BTC took many investors by surprise. According to a crypto participant known as 0xNobler on the social media platform X, the whale address became active for the first time since 2011 and went all in on Bitcoin again. Such a purchase goes against the trend of Satoshi-era whales becoming active after many years to sell their holdings.

The claim of purchase is very bullish on the outside, but there are also bearish interpretations of the move. The bearish interpretation is based on market psychology and the historical behavior of early Bitcoin holders.

A wallet allegedly active since the Satoshi era would have acquired BTC at negligible prices, often well below $1. From that perspective, the idea that such an entity waited more than a decade only to buy aggressively near all-time highs appears illogical.

A critic argued that sudden movements involving billions of dollars at the current price action indicate preparation. According to the critic, the entity behind the whale address is preparing to distribute. Large transfers into newly active wallets can be part of liquidity staging, designed to allow gradual distribution without causing immediate panic.

Satoshi-Era Whale Story Appears To Be A Misunderstanding

Closer inspection of the on-chain data indicates that the dramatic narrative surrounding this event rests on questionable assumptions. A few other crypto market participants pointed out that the circulated image claiming a Satoshi-era whale went all in on Bitcoin is edited and misleading, and that the receiving address labeled ‘3FsDiW’ may not belong to an early individual holder at all.

Interestingly, blockchain trackers link the address to Twenty One Capital, with records showing that it was created only a few days ago and the first transaction was first received on January 10, 2026. Transaction history shows a small test transfer of 1 BTC to Bitfinex, after which the remaining funds were consolidated into the new address ‘3FsDiW’ from another wallet already associated with Twenty One Capital.

Twenty One Capital is a publicly traded Bitcoin-focused company that reportedly holds more than 43,000 BTC on its balance sheet. This distinction matters, as it removes the existential fear implied by the original claims of a Bitcoin whale buying billions worth of Bitcoin.

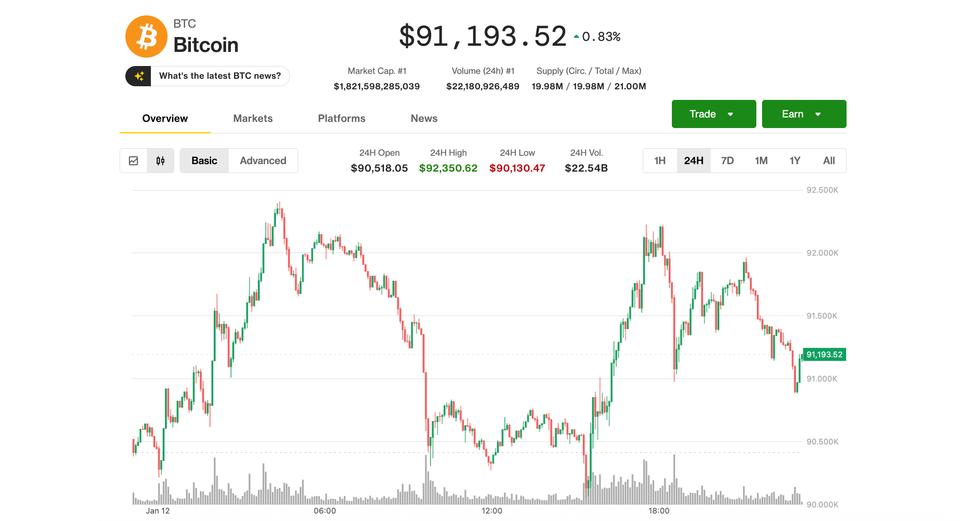

Featured image from Pngtree, chart from Tradingview.com

English (US) ·

English (US) ·