Binance Futures will launch silver perpetual contracts on Wednesday, offering up to 50x leverage on silver priced in U.S. dollars per troy ounce.

Jan 7, 2026, 8:19 a.m.

Binance Futures, the derivatives arm of the world's largest cryptocurrency exchange by trading volume, will launch silver perpetual contracts on Wednesday, enabling crypto traders to place leveraged bets on 2025's standout precious metal.

Perpetual futures contracts, or "perps," are derivative instruments that let traders bet on an asset's price without owning it and without expiration dates, using funding rates, typically every few hours, to keep prices aligned with spot markets. Their endless duration, high leverage options, and 24/7 access have made them wildly popular in crypto, generating billions in daily trading volume across exchanges.

The contract, launching at 10:00 UTC, offers up to 50x leverage on silver priced in U.S. dollars per troy ounce, allowing traders to control positions 50 times larger than their deposited margin and amplifying both gains and losses.

It's margined and settled in tether USDT$0.9990, the world's largest dollar-pegged stablecoin, with a minimum notional value of 5 USDT, the exchange said in an official announcement. Trading these perpetual futures will attract a funding fee, capped at ±2%, every four hours.

The impending launch comes weeks after the exchange debuted perpetuals tied to gold and shows that crypto traders are increasingly diversifying into precious metals, which outperformed the crypto market by leaps and bounds last year.

Silver chalked out a staggering 147% rally in 2025, hitting a record per ounce price of $83.75 at one point. As of writing, it changed hands at $79.84. Gold surged by more than 64% to $4,317, while bitcoin, the leading cryptocurrency by market value, ended the year down by more than 5%.

Both precious metals drew strength from fiscal and inflation concerns, with silver gaining extra momentum from surging demand in solar panels and electronics.

The silver contract will be available for futures copy trading within 24 hours of launch, Binance said in the announcement. Multi-assets mode will also let traders use cryptocurrencies like BTC as margin collateral, instead of just USDT, with haircuts applied to account for price volatility.

Binance is the first major exchange to offer perpetuals tied to silver, building on the trend pioneered by relatively smaller venues like MEXC and BTCC.

More For You

KuCoin Hits Record Market Share as 2025 Volumes Outpace Crypto Market

KuCoin captured a record share of centralised exchange volume in 2025, with more than $1.25tn traded as its volumes grew faster than the wider crypto market.

What to know:

- KuCoin recorded over $1.25 trillion in total trading volume in 2025, equivalent to an average of roughly $114 billion per month, marking its strongest year on record.

- This performance translated into an all-time high share of centralised exchange volume, as KuCoin’s activity expanded faster than aggregate CEX volumes, which slowed during periods of lower market volatility.

- Spot and derivatives volumes were evenly split, each exceeding $500 billion for the year, signalling broad-based usage rather than reliance on a single product line.

- Altcoins accounted for the majority of trading activity, reinforcing KuCoin’s role as a primary liquidity venue beyond BTC and ETH at a time when majors saw more muted turnover.

- Even as overall crypto volumes softened mid-year, KuCoin maintained elevated baseline activity, indicating structurally higher user engagement rather than short-lived volume spikes.

More For You

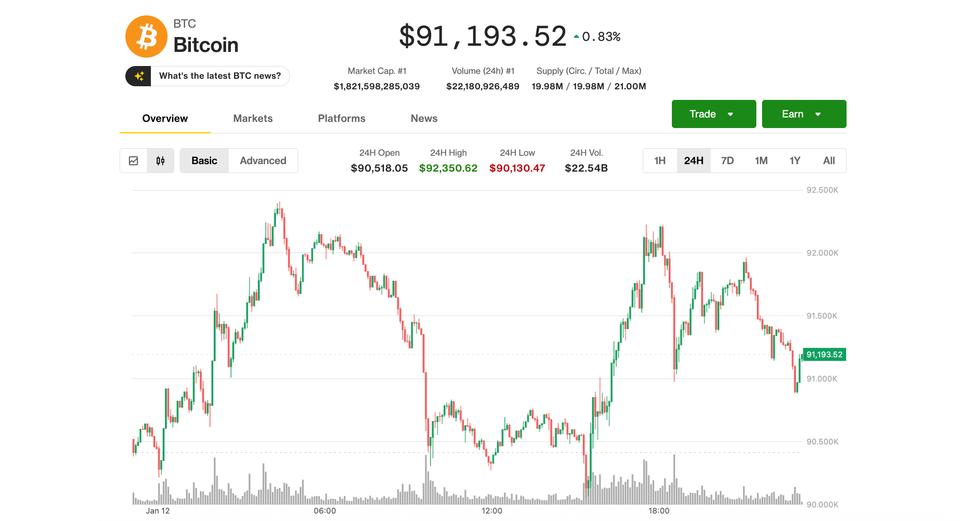

Bitcoin and the Japanese yen are moving together like never before

The 90-day correlation between bitcoin and JPY has risen to a record high of over 0.85.

What to know:

- Bitcoin's correlation with the Japanese yen has reached a record high.

- Both BTC and the yen took a beating in final months of 2025, with sell-offs in both running out of steam after mid-December.

- The tight correlation weakens BTC's appeal as portfolio diversifier.

5 days ago

1

5 days ago

1

English (US) ·

English (US) ·